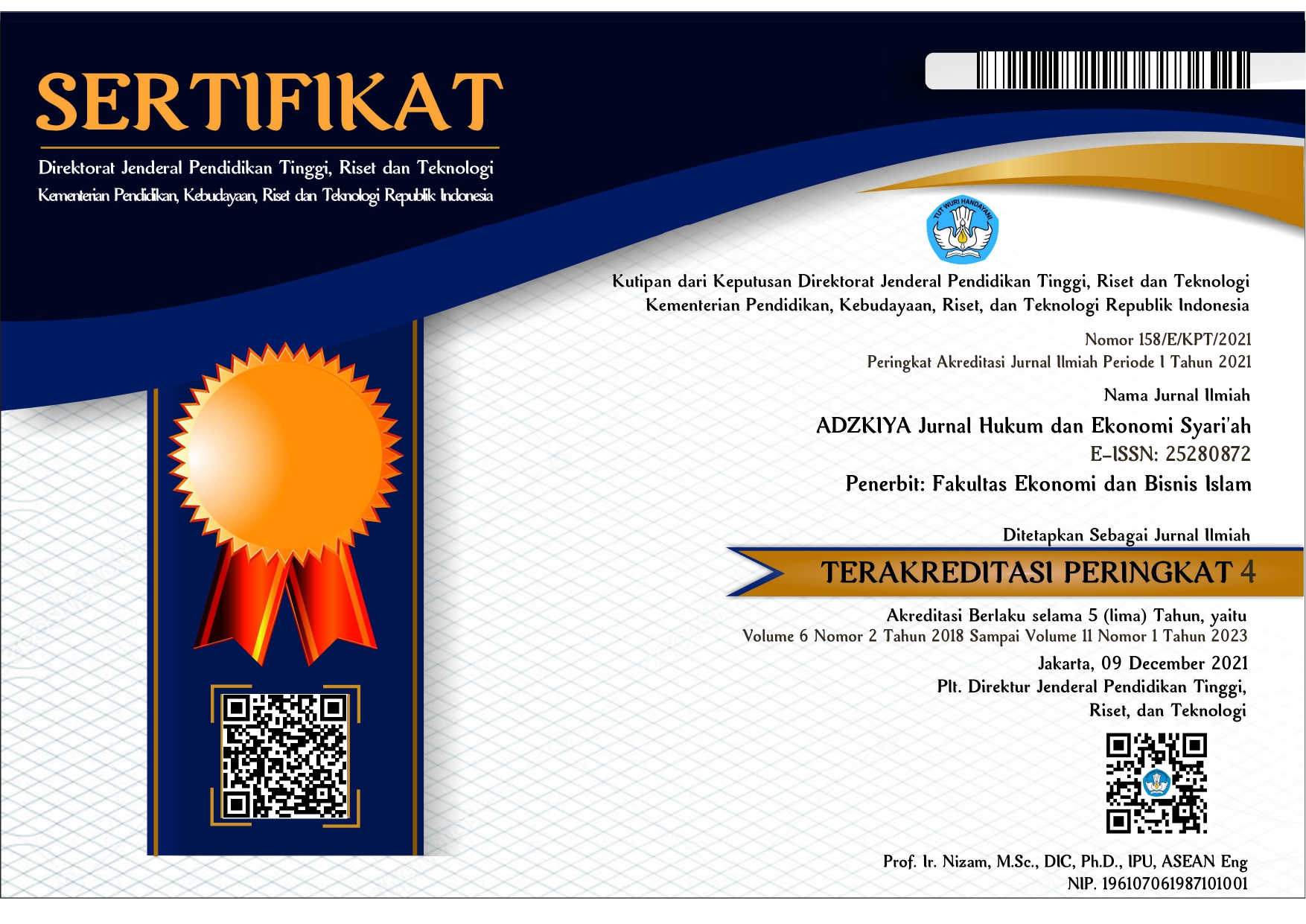

Analisis Hukum Ekonomi Syari’ah terhadap Mekanisme Fundraising Dana Zakat Melalui Bank Konvensional pada BAZNAS Kota Bandar Lampung

DOI:

https://doi.org/10.32332/adzkiya.v12i1.9263Keywords:

Fundraising, zakat, conventional bank, maqhosid syari'ahAbstract

MUI Fatwa No. 1 of 2004 concerning Interest states that mu'amalah is not permitted using Conventional Banks because there is an Interest system in Conventional Financial Institutions and the practice of interest is haram. Fundraising zakat by BAZNAS Bandar Lampung City in practice is known to use Conventional Banks which are used in collecting zakat. This is contradictory and gives rise to speculation among the public because there is a discrepancy between the fundraising mechanism at BAZNAS Bandar Lampung City and the MUI fatwa No.1 of 2004. This research is field research with a descriptive qualitative approach. Data sources come from primary data and secondary data. The results obtained in this research are: First, the fundraising mechanism for zakat funds is carried out directly, namely muzaki go directly to the BAZNAS / UPZ office and indirectly, namely through transfers to bank accounts, including using conventional banks. This was done because of the existence of an MoU with the Bandar Lampung City Government in optimizing the collection of ASN zakat, the regulations of which are carried out by Regional Banks, and Commercial Banks are used to facilitate and target Muzakki who are not familiar with Sharia Banks, Commercial Banks are used only as a channel for zakat/UPZ (zakat collection unit), deposited and managed by Sharia Bank account. Second, the use of conventional banks in collecting zakat carried out by BAZNAS Bandar Lampung City from the perspective of sharia economic law based on findings and facts that occur in the field and based on maslahah murlah may be done because there are benefits and maslahah for many people (not problems for the interests of one group or certain individuals) and reject harm in order to maintain the goals of shara' (maqashid shari'ah)

References

Alimuddin, A., Putri, F. M. E., Atasoge, I. A. Ben, & Alvia, R. (2022). Baitul Mal dan Ghanimah Studi Tentang Ijtihad Umar Bin Khattab dalam Penguatan Lembaga Keuangan Publik. Jurnal Akuntansi Dan Perbankan Syariah, 05(01), 31–44. https://doi.org/https://doi.org/10.32332/finansia.v5i01.4823

Faizin, M. (n.d.). Kementerian Agama Optimis Kampung Zakat di Lampung Bakal Berjalan dengan Baik.

Fikri, A. (2019). Fleksibilitas Hukum Islam. Jurnal Hukum Ekonomi Syariah, 11(2), 147–157. https://doi.org/http://dx.doi.org/10.24042/asas.v11i2.5603

Hasbi Zaenal, M. (2022). Potensi Zakat BAZNAS RI. BAZNAS Badan Amil Zakat Pusat Kajian Strategi, September, 2–3.

Khaeruman, B. (n.d.). Hukum Islam dalam Perubahan Sosial. Pustaka Setia.

Mahardika, I. S., & Ghofur, R. A. (2021). Optimalisasi Potensi Zakat : Faktor Yang Mempengaruhi Muzzaki Membayar Zakat Di Baznas Lampung Tengah. Jurnal Niara, 13(2), 1–10. https://doi.org/https://doi.org/10.31849/niara.v13i2.4311

Mahli Rahmawati. (2019). Bank Konvensional Dalam kontroversi keharaman Bank konvensional. Jurnal Syarah, 8(1), 97–114.

OJK. (n.d.). Telisik Lebih Dekat Perbankan Syai’ah.

Peraturan Pemerintah Nomor 14 Tahun 2014 tentang Pelaksanaan Undang-Undang Nomor 23 Tahun 2011 Tentang Pengelolaan Zakat. (n.d.).

Ramli, M. (2021). Politik Hukum Pengelolaan Zakat di Indonesia (Studi Tentang Zakat Untuk Mengentaskan Kemiskinan). Universitas Islam Indonesia.

Santoso, R., Zaharah, R., Taqwa, S. U., Dwilestari, I., & Hasanah, U. (2023). Kajian Filsafat: Zakat Sebagai Sumber Keuangan Negara. IJRC: Indonesian Journal of Religion Center, 1(1), 1–7. https://doi.org/10.61214/ijrc.v1i1.7

Shobirin. (2014). Pemikiran Abu Bakar Ash-Shiddiq Tentang Memerangi Orang Yang Membangkang. ZISWAF: Jurnal Zakat Dan Wakaf, 1(1), 189–211.

Undang-Undang Republik Indonesia Nomor 23 Tahun 2011 Tentang Pengelolaan Zakat. (n.d.).

Zaenal, M. H., Choirin, M., Hartono, N., Farchatunnisa, H., & Rarasocta, A. V. (2022). Potensi Zakat BAZNAS RI. In BAZNAS Badan Amil Zakat Pusat Kajian Strategi (Issue September). Pusat Kajian Strategis – Badan Amil Zakat Nasional (Puskas BAZNAS).